Top Challenges Facing the Health Insurance Industry

From shifting consumer expectations to cybersecurity threats to demographic changes driving up utilization and costs, the health insurance sector in North America faces numerous challenges requiring it to rethink its operations. A few of these challenges and dynamics include:

- Shifting consumer expectations: Consumer expectations for health insurance have changed significantly over the last few years. These changes are driven by technological advancements, increased access to information, and broader shifts in consumer behavior. Major trends include:

- Digital first: Today’s consumers expect digital-first interactions — from purchasing policies to making insurance claims. Additionally, the convenience introduced by apps, chatbots, and online portals for 24/7 has become a standard expectation among customers.

- Transparency: There’s a growing demand for clear, straightforward information about what is covered, the costs involved (including premiums, deductibles, and out-of-pocket expenses), and the procedures for claims. All this needs to be clearly understood by the consumer without any jargon. Hidden fees should also be avoided.

- Personalization: Today’s consumers want health insurance policies tailored to their needs, lifestyle, and financial situation. This includes customizable plans, wellness programs, and incentives for healthy behavior.

- Value-based care: There’s an increasing preference for insurance models that focus on outcomes rather than services provided. Consumers are more attracted to plans prioritizing preventive care, wellness, and the quality of care over which specific services are offered.

- Integrated care: Expectations are leaning towards more integrated healthcare experiences where insurance plans facilitate seamless communication between different healthcare providers, ensuring more coordinated, efficient care.

- Mobile health services: With the rise of telehealth and mobile health apps, consumers expect their health insurance to cover and integrate with these services, offering them convenient access to healthcare anytime, anywhere.

- Higher costs: Numerous factors are driving up costs in the health insurance industry, including:

- Changing demographics. As the population ages, healthcare costs for seniors increase, their medical needs change, and medical costs increase. The combination of both has changed where the industry earns profits and puts downward pressure on profit margins. In fact, McKinsey predicts the mix of profit pools will likely shift towards the government segment as more seniors enroll in the Medicare Advantage and drop out of the Group (company) and individual segments.

- Shifting economic conditions. Changes in the economy affect the healthcare industry. For example, in the event of an economic slowdown, insurers can expect to see a shift from fully insured to self-insured businesses accelerating. This ultimately puts downward pressure on margins.

- Rise in utilization: The increase in utilization has driven up costs for insurers. For example, the increase in effective but expensive therapies (such as broad population drugs) has increased payers’ costs.

- Cybersecurity risks: As the industry has adopted digital technology widely in the past decade, cybersecurity risks have increased dramatically. Considering most insurance companies deal with vast amounts of sensitive customer information, they are highly attractive targets for hackers. Healthcare insurers must protect this customer data to maintain customer trust and avoid legal consequences. However, doing so is costly and requires organizations to invest in solid security policies, procedures, ongoing employee training, and modern cybersecurity tools.

- Talent shortages: According to Amtrust Financial, more than 400,000 insurance employees are expected to retire in the next two years. Additionally, 44% of millennials are not interested in careers in insurance.

- Increase concentration of health insurance markets as a result of mergers and acquisitions. The American Medical Association (AMA) released a report in Dec. 2023 that the concentration of health insurance markets in the United States is currently high and is increasing. This is mainly a result of mergers and acquisitions. The increasing concentration is a key factor driving up premiums. Additionally, M&As raise many new issues company executives need to address, including integration of operations, realizing cost synergies, driving cultural integration, and addressing customer retention impacts of the merger/acquisition.

The Use of AI in the Health Insurance Industry

As the number of challenges within the health insurance industry grows, insurers seek ways to use AI to overcome these challenges and improve existing processes. Below are a few ways AI is being utilized in the health insurance sector:

- Claims processing: By leveraging AI algorithms and machine learning, insurers can streamline the claims settlement process. This reduces the need for manual intervention and improves accuracy. For example, the technology can quickly extract relevant information from claims, summarize it, and identify fraudulent claims or anomalies in data. This enables insurers to write accurate claims more quickly, saving valuable time.

- Personalized customer service: AI can quickly analyze vast amounts of customer data, including past interactions, policy preferences, and demographic information. With these insights, insurers can tailor their offerings and communication strategies to customers’ individual needs. Additionally, generative AI can create automated communications to policyholders regarding premium payment reminders and policy updates or inform them of relevant content.

- Risk assessment: AI can enhance risk assessment and underwriting processes, enabling insurers to analyze risks more effectively and accurately. For example, companies can analyze patient data to identify individuals at higher risk of developing chronic conditions, which enables insurers to offer preventive care and manage healthcare costs more effectively and proactively.

- Underwriting: Generative AI can help streamline the underwriting process by analyzing large data sets, including customer information and historical factors. The technology can create risk profiles and even provide recommendations for appropriate coverage levels with this information.

Impact of AI on the Workforce in the Health Insurance Industry

Human intelligence augmentation. As AI continues to evolve, so do the roles of professionals in the health insurance industry. While some fear job displacement due to automation, some executives view AI as a boon for enhancing employee productivity and driving efficiency.

AI is more about improving employee performance than rationalizing staff, said Sonny Goyal, senior vice president diversified business group and chief strategy officer Blue Shield and Blue Cross of North Carolina. “We have to be really thoughtful about how we use AI—how quickly we go at it, and how we prioritize where we test things. But I don’t think about AI as how many jobs I can cut. I actually think about AI as how I turn a person into a superhuman, how I put more data, more insights, at their fingertips, whether they’re in a call center, or anywhere in the organization, [to enable them] to be better informed and help our members in a better way.”

Eliminating repetitive tasks. AI’s major impact on the workforce is the ability to automate repetitive and mundane tasks that take up much of employees’ time. By doing so, employees can focus on higher-value tasks. AI technologies can streamline claims processing and administrative tasks, freeing time to focus on strategic decision-making and customer interactions.

“Think of the power of generative AI to take out a bunch of manual work that we do on both the payer side and the provider side,” said Martha Wofford, president and chief executive officer of Blue Cross and Blue Shield of Rhode Island. “It feels like we are on the precipice of unlocking a ton of savings and value.” (source:

Increasing personalization of services. Another area where AI is used in the healthcare industry is to improve decision-making and deliver better, more personalized services to customers. By analyzing large amounts of healthcare data, AI can identify trends, predict patient needs, and create customized insurance plans.

A quote from Eric Topol’s book “Deep Medicine: How Artificial Intelligence Can Make Healthcare Human Again” says: “The greatest opportunity offered by AI is not reducing errors or workloads, or even curing cancer: it is the opportunity to restore the precious and time-honored connection and trust—the human touch—between patients and doctors. Not only would we have more time to come together, enabling far deeper communication and compassion, but also we would be able to revamp how we select and train doctors.”

Employee training. AI is also being utilized in employee training and upskilling. Generative AI apps that learn from corporate training resources can make knowledge far more accessible and digestible for employees, helping people learn better and faster. Alex Gourlay, co-COO of Walgreens Boots Alliances, said: “AI-powered training platforms offer employees on-demand access to learning resources and personalized coaching, allowing them to develop new skills and stay competitive in the evolving healthcare landscape.”

Ultimately, AI can be used to enhance human performance, driving productivity and creating better outcomes for both employees and customers.

Getting Started with AI: Key Considerations

As health insurance companies look to get started with AI, there are key considerations to ensure successful implementation. First, it’s better to start with a few use cases that are valuable and feasible and can be prototyped and released quickly (within a few weeks or months). Businesses should consider applying generative AI and other newer technologies to targeted initiatives to learn, develop skills, and secure early wins that can be used to build momentum and gain buy-in.

Secondly, organizations must focus on data quality and availability – the fuel for AI models. Organizations with data in messy, siloed legacy systems must extract that data and store it within a data lake before it can be used in a data model. Additionally, organizations should have designated individuals to improve data quality, data infrastructure, and the flow of information needed for AI-powered decision-making. Additionally, health insurance providers must be extra careful about protecting patient confidentiality and obtaining proper patient consent before using their data for AI model training.

Organizations that may not have the people in place to manage the flow of information should rely on vertical AI solutions for these certain use cases. For example, Docugami provides Document Engineering solutions that unlock the critical data trapped in carrier quotes, contracts, agency proposals, loss runs, statements of values, and other documents used by commercial insurance companies. Several top U.S. health insurance and property and casualty insurance companies use the solution.

Third, organizations should consider how roles and jobs need to shift to make the best use of talent in an age of AI and invest in upskilling their workforce. As AI becomes more integrated with health insurance processes, new roles and operating models will emerge. Organizations shouldn’t underestimate the need for human intervention and oversight of AI systems.

Finally, organizations should establish an AI Center of Excellence (COE) to drive AI implementation and innovation across the organization and identify and manage risks. The COE is your in-house team of experts who ensure the right resources and talents are in place to drive AI innovation. More simply, the COE applies the technology in all the right places to drive maximum business value while minimizing risks.

Managing AI Projects through a Lifecycle Approach

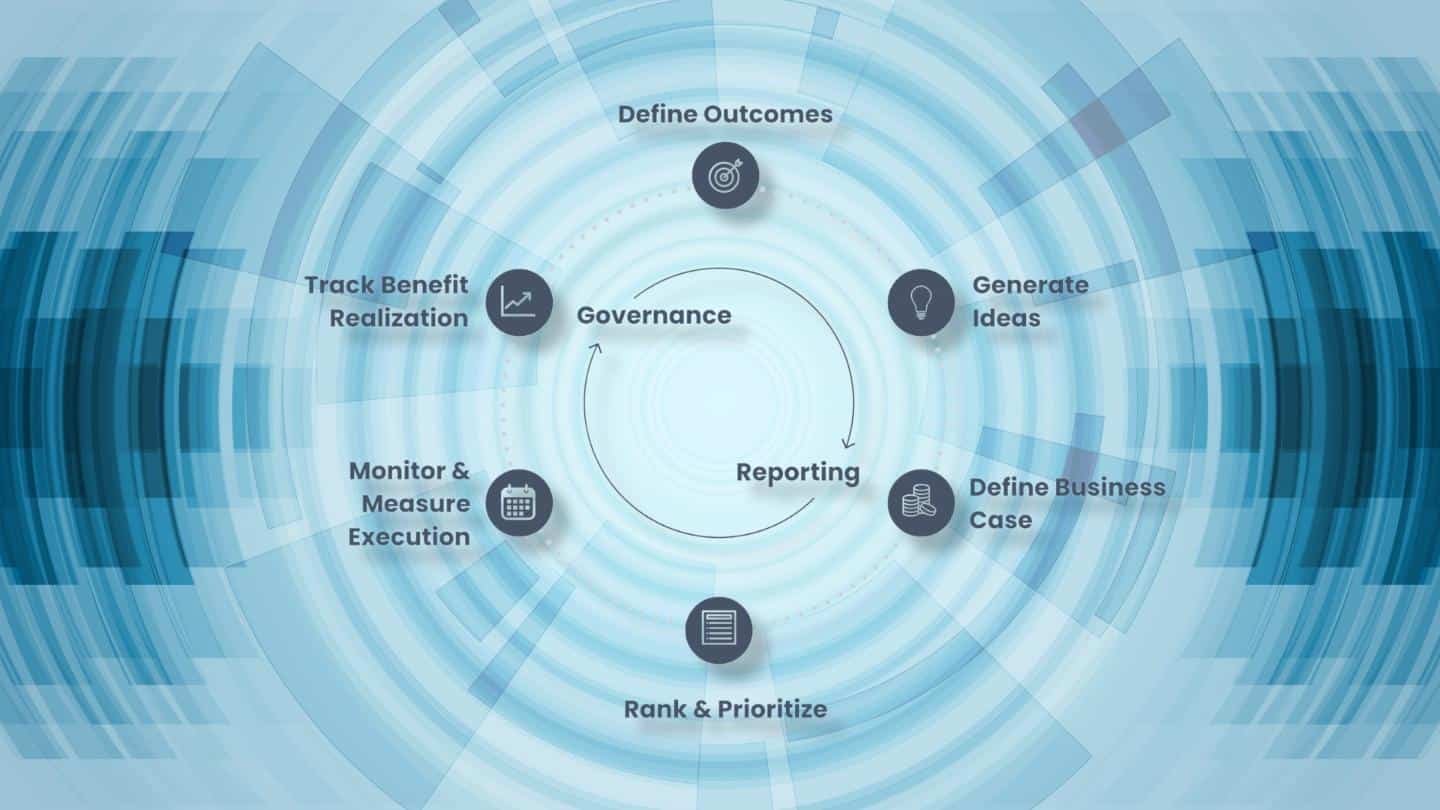

Because there are many use cases for AI within your organization, taking a deliberate, consistent approach to AI projects is important. This ensures you can deliver tangible business benefits quickly and not waste too many precious resources on bad bets. One recommended approach is Shibumi’s AI Lifecycle.

This approach starts with identifying a few concrete problems first and generating AI solution ideas. Then, a small, qualified group will evaluate all proposed AI ideas and narrow the list down to just a few for prototyping. Decisions are made based on the use cases’ value, feasibility, and risks. This approach emphasizes the importance of developing prototype (or pilot) solutions first to validate the value hypotheses of AI use cases (“Will this AI solution increase this business KPI by Z percent?”) and using feedback from the pilot to decide whether an AI solution is ready for wider implementation, it needs refinement, or it needs to be stopped altogether.

Once decision-makers decide that certain prototype solutions are worth implementing more widely, a small, interdisciplinary team thinks through all potential implementation hurdles and addresses them to maximize the chances of the solution gaining traction. Once a new AI solution is rolled out, a team monitors its usage and business benefits and makes adjustments to ensure it delivers the expected business value.

In addition to our AI Lifecycle, consider using a software tool like Shibumi’s AI Value Accelerator to stay organized.

This software helps companies govern AI projects, manage them through a lifecycle, and drive measurable business value. The centralized AI Idea Hub helps you source ideas centrally from a secure platform, and a prioritization engine helps you leverage out-of-the-box reports to prioritize the AI opportunities that will provide the most ROI.

Ready to see Shibumi in action? Request a demo today.